This article details the documents required for organizations to open an account with Airwallex if their business is registered in Vietnam, the Philippines, Indonesia, India, or Thailand.

Verification, known as KYC or ‘Know your customer’, is a process regulators require to offer financial services to organizations and individuals. It involves reviewing and maintaining information on parties that use our financial services.

As a Company account, you may need to prepare the documents below:

-

Certificate of Business Registration

- Vietnam company

- Philippines

- Indonesia Company

-

India

- Companies and Limited Liability Partnerships

- Proprietorships and Partnerships

- MSMEs (Micro, Small and Medium Enterprises)

- Thailand Company

- Partnership Disclosure & Declaration Form (if applicable)

- Ownership Structure Chart (if applicable)

- Authorisation Letter Template (if applicable)

- Financial Institution Onboarding Questionnaire (if applicable)

- Live Streaming Questionnaire (if applicable)

- Online Marketplace Onboarding Questionnaire (if applicable)

- Source of Wealth Attestation (if applicable)

- ID of UBO (if applicable)

- ID of Authorised Person (if applicable)

- Individual Address Proof (if applicable)

Please ensure the image is clear and readable. The file shall not exceed 10MB, limited to {PDF, Word, JPG, JPEG, PNG, BMP}

Company Information

For a Vietnam Company account, you need to prepare the documents below:

Business Registration Certificate

Please provide any of the following as second verification documents, which include a list of shareholders and directors' information and should fulfill the following requirements:

1. Bank statement (within six months) of the account under your company's same name;

2. Company's public documents (e.g., tax filing/audited annual report/financial report, within one year);

3. Articles of Incorporation

For a Philippines Company account, you need to prepare the documents below:

Certificate of Incorporation

General Information Sheet (with the acknowledgment by the Securities and Exchange Commission on the copy)

The General Information Sheet should fulfill the following requirements:

1. The above document copy should be certified to be genuine by an independent and appropriate person, including but not limited to a registered lawyer, CPA, or notary;

2. The certifier should sign the copy, and indicate his/her name and capacity/position on it;

3. The certified date should be indicated and within 12 months;

4. The certified document should be in English, or include an English translation.

For a Philippines Sole Proprietor, you need to prepare the documents below:

Sole Proprietorships (DTI-Registered)

Please provide any of the following as second verification documents, which include a list of shareholders and directors' information, and should fulfill the following requirements:

1. BIR Certificate of Registration

2. Bank statement (within six months) of the account under your company's same name;

3. Company's public documents (e.g., tax filing/audited annual report/financial report, within one year);

4. Articles of Incorporation

For an Indonesia Company account, you need to prepare the documents below:

Nomor Induk Berusaha(NIB) registration

Please provide any of the following as second verification documents, which include list of shareholders and directors' information and should fulfill the following requirements:

1. The document itself should be issued within 12 months; and should be certified to be genuine by an independent and appropriate person, including but not limited to a registered lawyer, CPA, or notary;

2. The certifier should sign the copy, and indicate his/her name and capacity/position on it;

3. The certified date should be indicated and within 12 months;

4. The certified document should be in English, or include an English translation.

Company Profile (Profile Perusahaan) retrieved from Directorate General of Legal Administration (Ditjen AHU) within 12 months:

For an India Company account, you need to prepare the documents below:

Companies and Limited Liability Partnerships (LLPs):

Certificate of Incorporation

Second verification document to continue to verify your business, acceptable verification documents include:

1.Articles of Association (AOA)

2.GST Registration Certificate

3.Business Permanent Account Number (PAN) Card

4.Bank Statement within 3 months

5.Audited Financial Statements or Internal Audit Reports

A signed ownership structure chart/partnership disclosure & declaration form is required

Proprietorships and Partnerships (other than LLPs):

GST Registration Certificate

Second verification document to continue to verify your business, acceptable verification documents include:

For partnership (any one of the following):

-Partnership Agreement

-Business Permanent Account Number (PAN)

-Company bank statement within 3 months

For Sole Proprietor(any one of the following):

-Individual Permanent Account Number (PAN) Card

-Bank statement within 3 months.

MSMEs (Micro, Small and Medium Enterprises):

Udyam Registration Certificate

GST Registration Certificate

If the MSME is Companies and Limited Liability Partnerships, a signed owenrship structure chart/partnership disclosure & declaration form/partnership agreement is required.

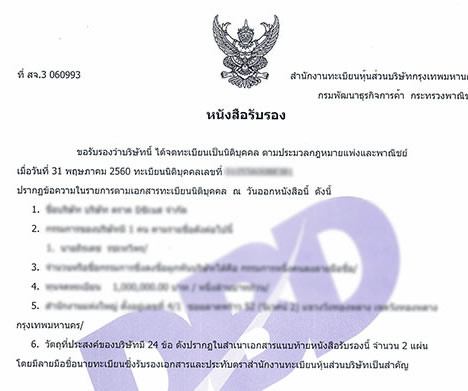

For a Thailand Company account, you need to prepare the documents below:

Certificate of Incorporation

Certificate of Business Registration (translated into English and certified by a professional translator)

List of Shareholders (translated into English and certified by a professional translator)

Partnership Disclosure & Declaration Form

Please provide a copy of your partnership agreement and make sure the agreement clearly indicates each partner's capital contribution to the partnership (in percentage).

Click here to download the PARTNERSHIP DISCLOSURE & DECLARATION FORM template

Ownership Structure Chart

If the ownership structure of your business could NOT be fully identified through a reliable source, please provide us with the most recent shareholder register or ownership diagram that meets the following requirements:

- Full Legal Name and shareholding percentage of the Ultimate Beneficial Owner (any individuals holding with 25% or more ownership share or voting rights);

- Registration country and shareholding percentage of each intermediary shareholding entity;

- If there are no individual Ultimate Beneficial Owners, then please declare in the shareholding structure and provide information on the key controller;

- The document should be signed and dated by a director along with his/her printed name; the director's signature can be provided either in a handwritten or electronic way (e.g. DocuSign; Adobe Sign);

- The signed document should be issued within 12 months and cannot be altered or edited.

Click here to download the example of Ochart

Click here to download the example of the Ochart for a group holding company

Sample:

Authorization Letter

If you are not a director or ultimate beneficiary owner (UBO) of the business registered in Philippines, India, or Thailand, we require that you provide a letter stating you have the authority to act on behalf of the company.

Note: The letter should be signed and dated by a director of your company.

Click here to download the Authorisation Letter Template

If your business has multiple legal entities that are registered in different countries/regions and would like to onboard them all at once, you may use this Global Authorisation Letter Template, instead of using a separate template per each country/region.

Click here to download the Global Authorisation Letter Template

If you are a channel partner opening an account on behalf of your client, please use this Authorisation Letter Template instead.

Note: The letter should be signed and dated by a director of the company you are representing.

Click here to download the Authorisation Letter Template for channel partners

Financial Institution Onboarding Questionnaire

If your company is a Financial Institution, please follow the guidelines to input the Questionnaire below:

Click here to download the Financial Institution Onboarding Questionnaire

Investment Onboarding Questionnaire

If the Airwallex account is for a company that will engage in investment activities, please complete the following questionnaire and provide all requested supporting documents

Click here to download the Investment Onboarding Questionnaire

Live Streaming Questionnaire

Click here to download the Live Streaming Questionnaire

Gaming Questionnaire

Click here to download the Gaming Questionaire

Online Marketplace Onboarding Questionnaire

Click here to download the Online Marketplace Onboarding Questionnaire

Source of Wealth Attestation

Click here to download the Source of Wealth Attestation

Personal Information

Ultimate Beneficial Owner (UBO)

The "Ultimate Beneficial Owner" of a legal entity is thus:

- one who holds 25% or more of share capital; or

- one who exercises 25% or more of the voting rights; or

- one who exercises ultimate control over the management of the corporation

Authorised Person

An Authorised Person is authorized to act on behalf of the business.

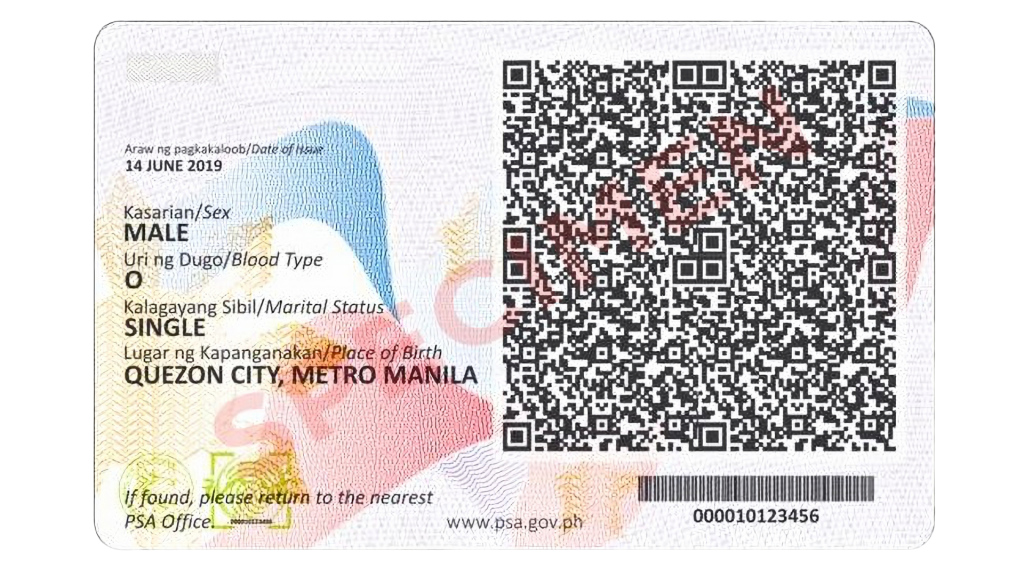

Personal ID

Please provide images for government-issued, official photo ID, such as passport, national ID or Driver's licence (if applicable).

Note: Please keep the ID photo clear, with complete edges, no occlusion, no reflection, no watermark, etc. and, it is recommended to lay the document flat and shoot vertically in a well-lit place.

Some valid ID examples are provided below:

-

Passport - All Countries

- National ID (certified true copy by a professional person) -

Vietnam National ID

Philippine National ID

Indonesian National ID

Individual Address Proof

Address proof is required for both UBO and PPTA. If the authorized person is not one of your entity's directors, please provide the address proof of the authorized person.

The common acceptable address proof will be either of the following in Latin Characters:

- Philippines, India, or Thailand National Registration Identity Card containing the address

- Bank statement

- Utility bill

- Current lease agreement

- Resident Permit

- A written declaration from the passport/ID holder that the address on the Passport/ID is the latest current residential address

And they should be:

- Recent (less than 6 months old for bank statements and utility bills)

- Must show name and address

- Cannot be cropped or blurry