You can now pay your employees and suppliers on Airwallex via a batch transfer using ABA (Australian Banking Association) files exported from your accounting software. Please note that ABA Batch Transfers are currently only able to be paid out in AUD.

You can make as many transfers on an ABA file as you'd like. There are no limits to the number of transfers supported per ABA file.

Transfers processed via ABA files will follow our usual processing times that you can see in our Payout Guide.

If you would like to create an international batch transfer please refer to the guide here.

1. Setting up before generating an ABA file

The 'From account'

Airwallex can accept ABA files with the 'from account' (an account from which funds are debited from) specified as any bank account as Airwallex deducts the funds from your Wallet and does not need to rely on this information.

For better reconciliation, you may want to set up the bank account you wish to fund the batch payment or pay run in the accounting software. In this case, you can enter your default AUD Global Account bank details accordingly in the BSB and Account number fields.

Direct Entry service number

When asked for the Direct Entry service number (sometimes also known as an APCA Number, DE user ID, BECS ID or BUDS ID, APCA number), simply use 000000.

Self-balancing transaction

You do not need to include a self-balancing transaction. If your ABA file includes the self-balancing transaction, it will not be processed.

For more details, please see the ABA file format specifications at the bottom of this page.

2. Generate ABA Files

Note the "Description of entries" and "Date to be sent" in the "Descriptive record" will be used to generate your batch transfer.

See the ABA file format specifications table below for the field specification and how Airwallex will use the information in an ABA file.

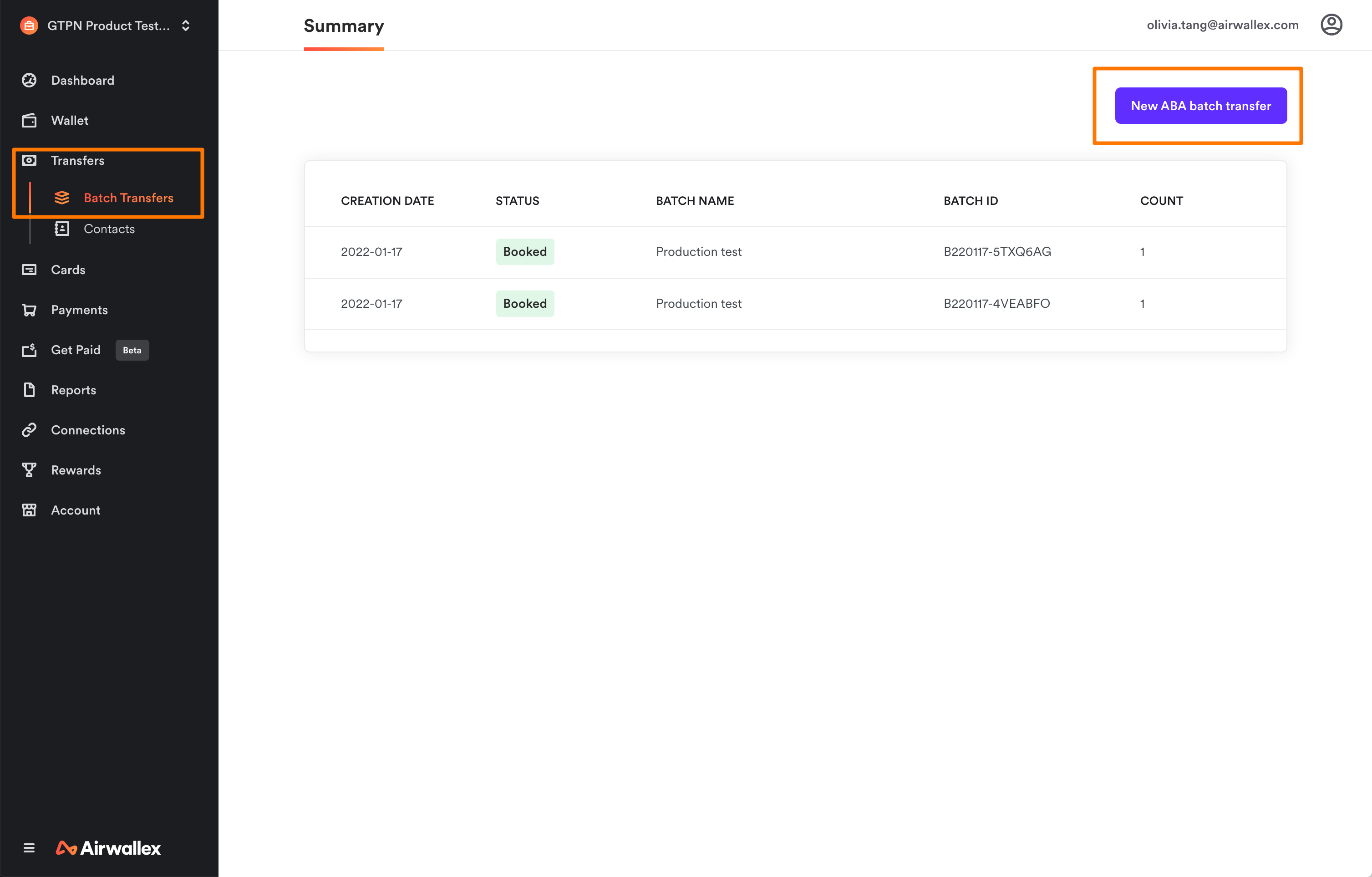

3. Log in to Airwallex, navigate to Transfers > Batch Transfers, and start by clicking on New ABA batch transfer

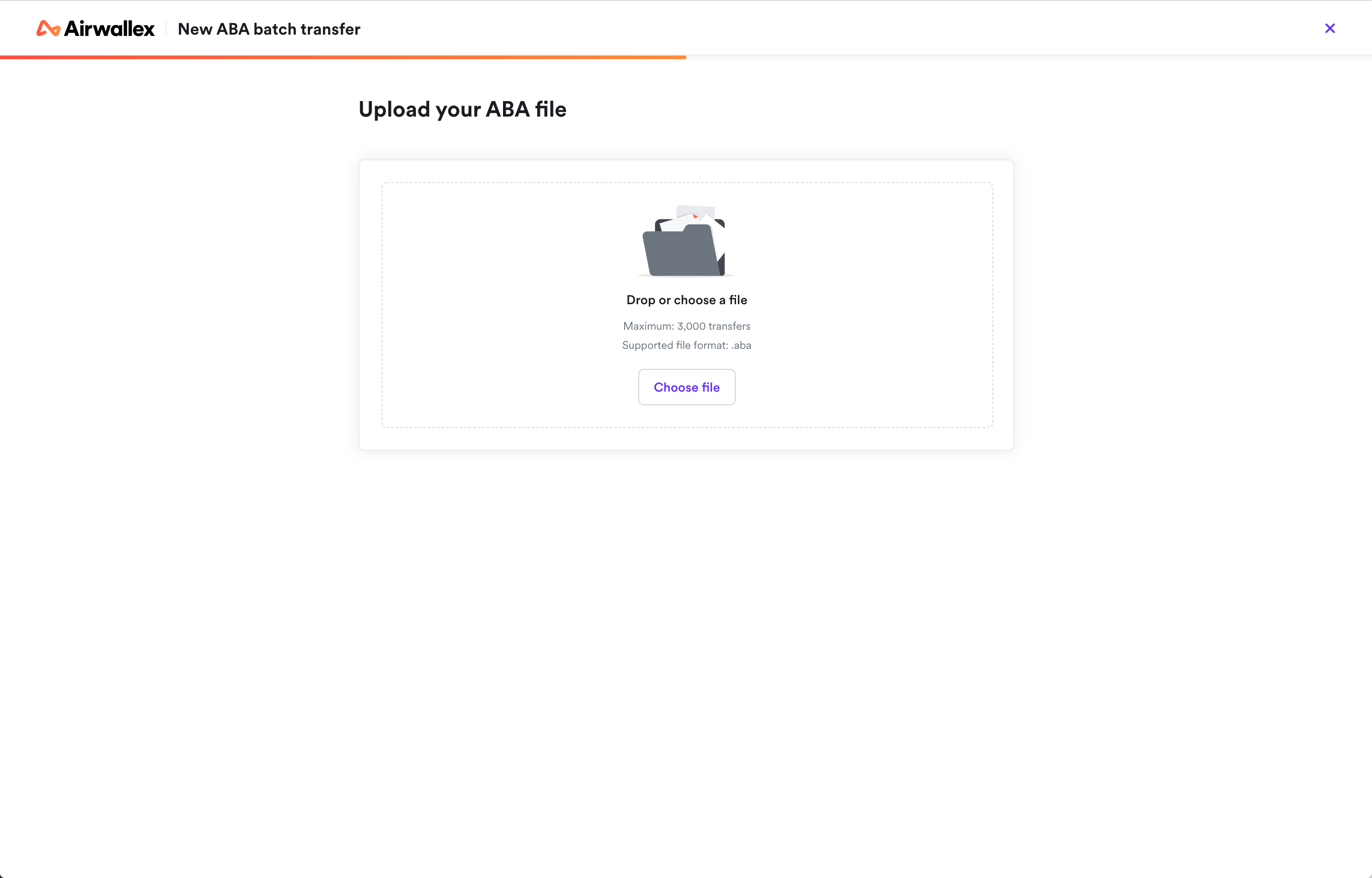

4. Upload your ABA file

Please note, the only file format supported is .aba and the maximum number of transfers that can be accepted per batch is 3000.

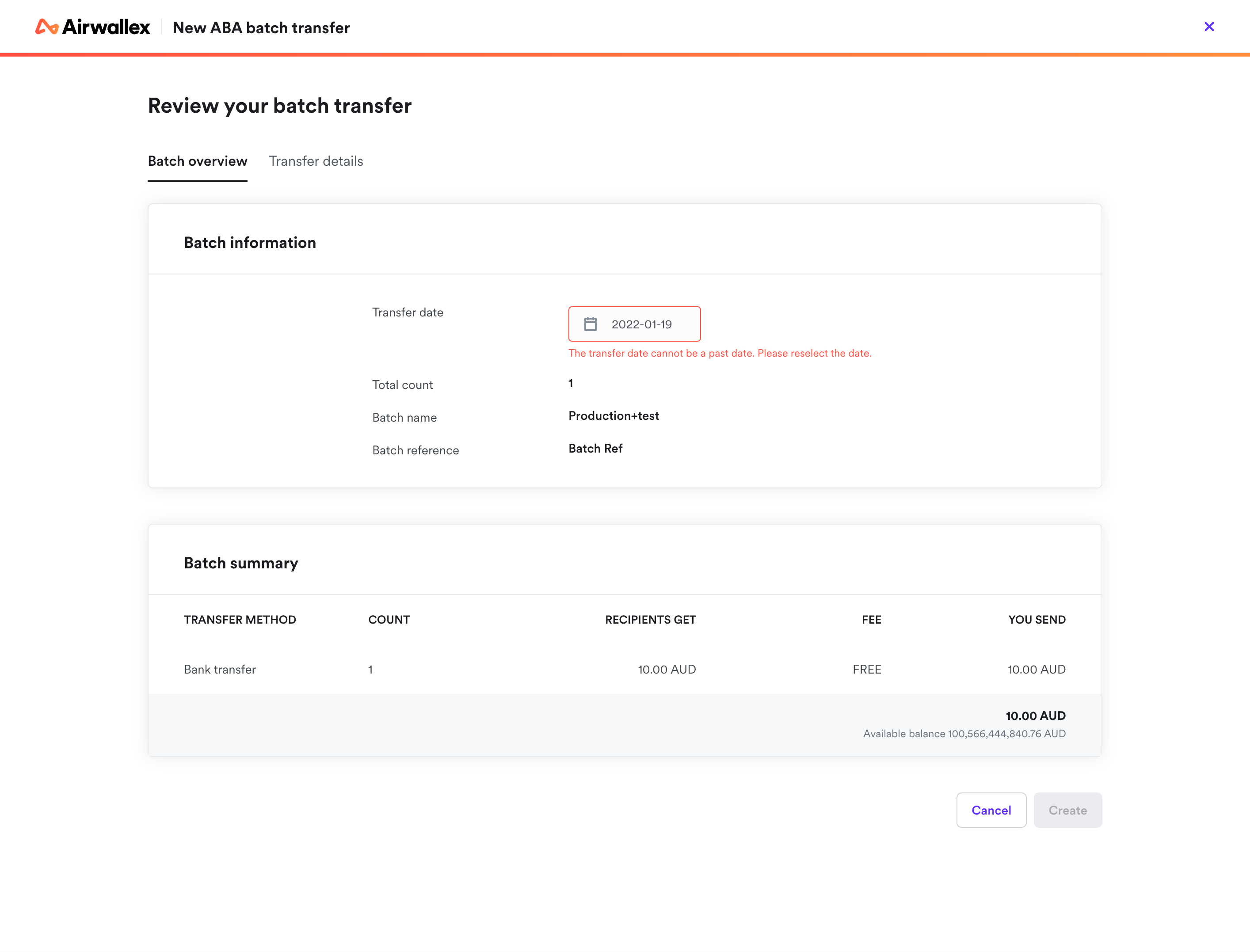

5. Update transfer date when it's expired

When your ABA file has an expired transfer date, you can update the date when reviewing the batch transfer.

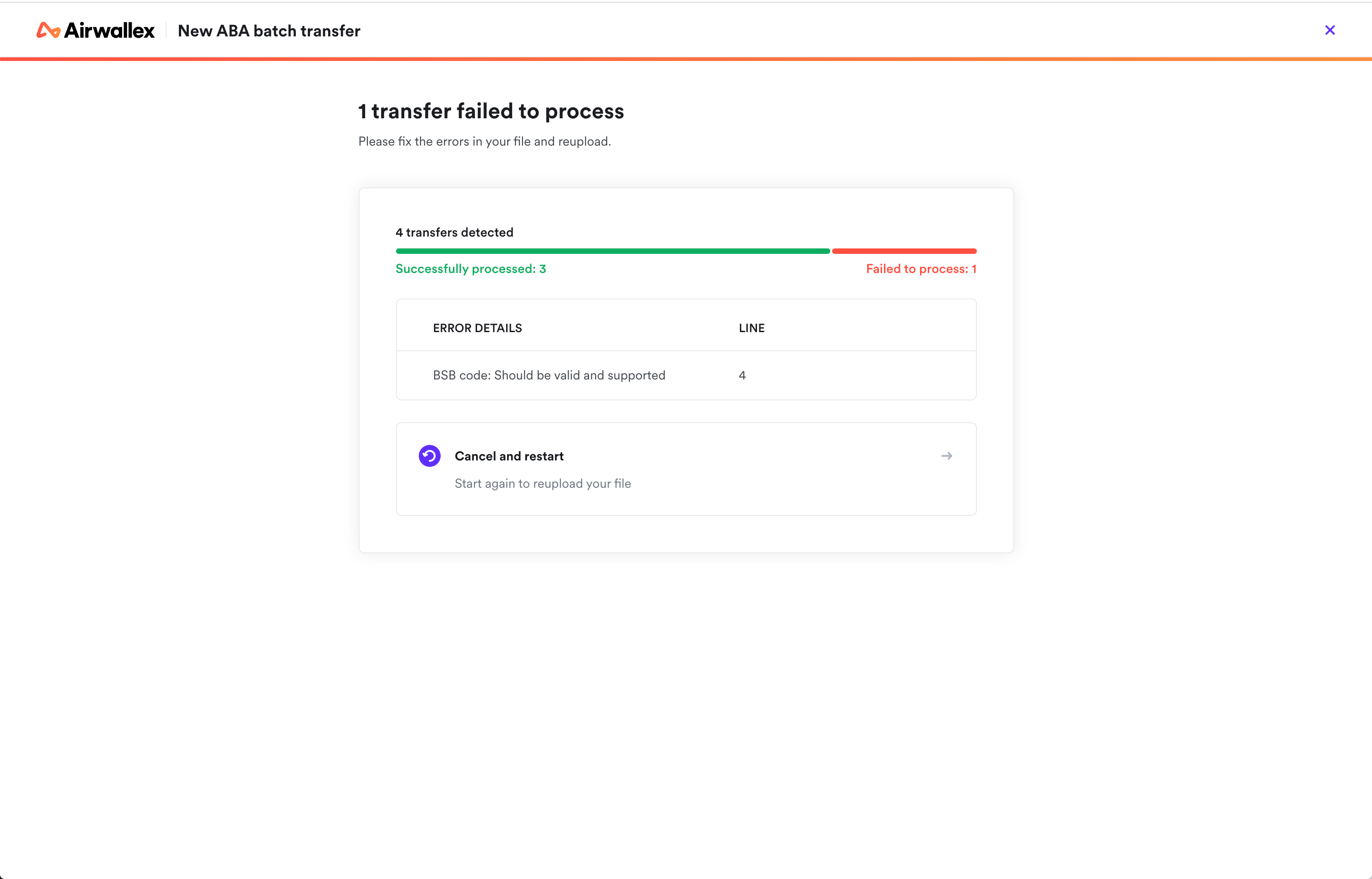

6. Fix any transfers that fail to process

When there are other types of errors in the file, you can re-generate the ABA file from your accounting software (after correcting the errors in your accounting software) and click Cancel and restart to re-upload your file. Common errors include:

- Incorrect BSB format: please ensure there is a hyphen, e.g., 000-000

- Transfer date: this needs to be in the format DDMMYY, and cannot be a date in the past

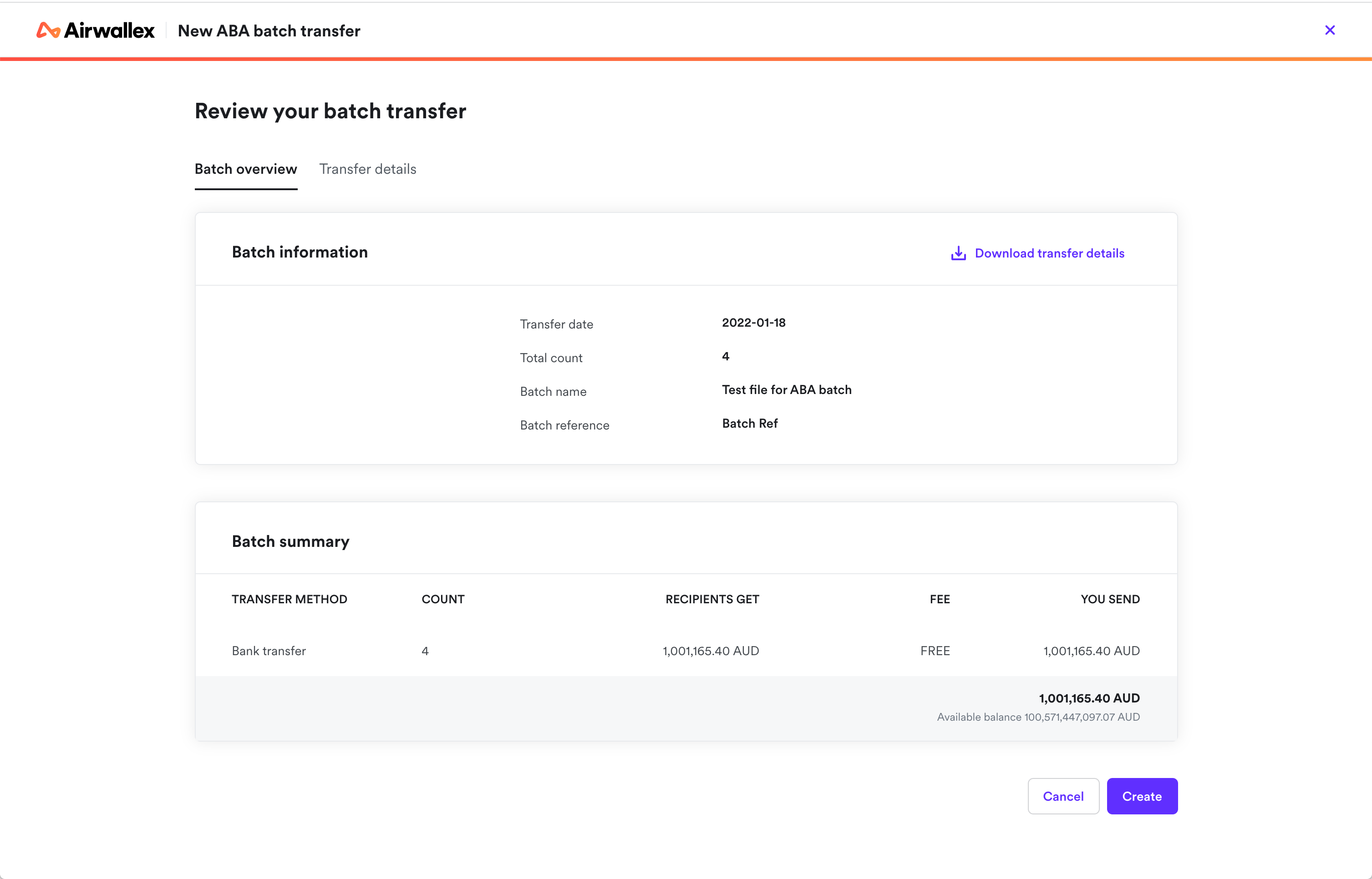

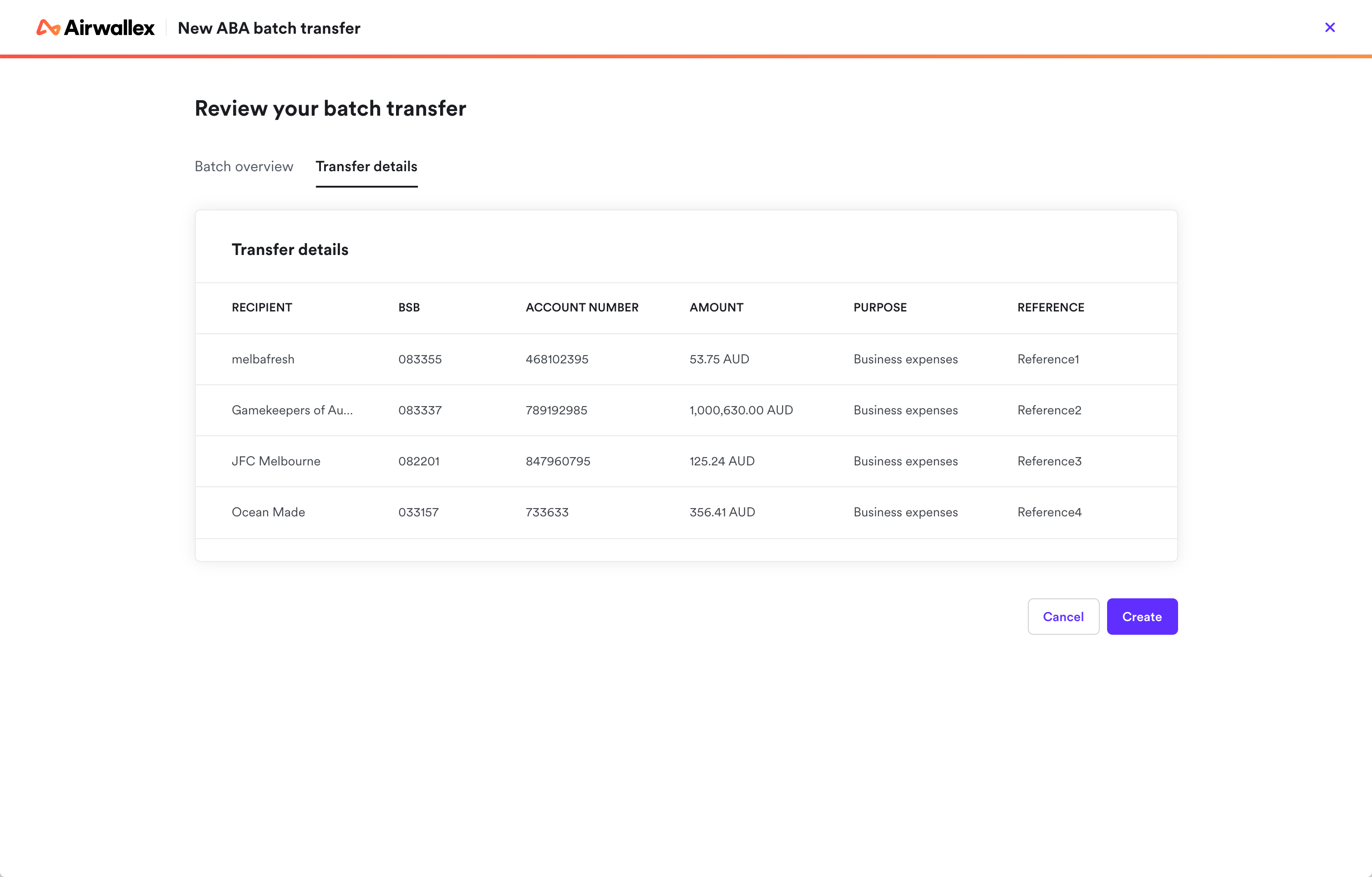

7. Review and create your batch transfer

You can view the total amount in the Batch Summary, and individual transfers in the Transfer details section.

Once reviewed, click Create to book the transfers.

If your account does not have transfer approval enabled, you can create the batch right away.

If your account has transfer approval enabled, the creator can submit the batch transfer for approval. The approver can then review and approve it in the Approval list.

See here to learn more about transfer approval.

8. View a created batch transfer

Once a batch transfer is created, you can view it in the Summary list. Transfers get booked after a batch transfer is created. A 'Booked' status of batch transfer indicates that all transfers within the batch are successfully created. For large-sized batch transfers, it takes longer to create all transfers. The transfer status can be tracked in the batch details.

Once a transfer is booked, the funds are deducted from the wallet immediately. If you have requested to set the fund deduction mode to be 'post-fund', the funds are deducted from your wallet on the transfer date.

The transfers are sent to the recipients on the transfer date specified in the ABA file.

ABA file format specifications

Descriptive record (type 0)

| Character Position | Field Size | Field Description | Specification | How Airwallex uses this information |

|

1 |

1 |

Record Type 0 |

Must be '0' |

Format validation |

|

2-18 |

17 |

Blank |

Must be kept blank. |

Format validation |

|

19-20 |

2 |

Reel Sequence Number |

Must be 01. Right justified. Zero filled. |

Format validation |

|

21-23 |

3 |

Name of User's Financial Institution |

Must be a 3-letter value. Can be "AWX" |

Format validation |

|

24-30 |

7 |

Blank |

Must be kept blank. |

Format validation |

|

31-56 |

26 |

Name of Use supplying file |

Must not be all blanks. All coded character set valid. |

Format validation |

|

57-62 |

6 |

Name of Use supplying file |

Must be numeric, right justified, zero-filled. Can be "000000" |

Format validation |

|

63-74 |

12 |

Description of entries on file e.g. "PAYROLL" |

All coded character set valid. Must not be all blanks. Left justified, blank filled. |

Used as a reference of a batch. |

|

75-80 |

6 |

Date to be sent to the recipients |

Must be numeric in the formal of DDMMYY. Must be a valid date. |

Used as the transfer date for all transfers. |

|

81-120 |

40 |

Blank |

Must be kept blank. |

Format validation |

Descriptive record (type 1)

| Character Position | Field Size | Field Description | Specification | How Airwallex uses this information |

|

1 |

1 |

Record Type 1 |

Must be '1' |

N/A |

|

2-8 |

7 |

Bank/State/Branch Number |

Must be numeric with a hyphen in character position 5, e.g., BSB 012-666 |

BSB code |

|

9-17 |

9 |

Account number to be credited |

Must be Numeric, right justified, blank-filled |

Account number |

|

18 |

1 |

Indicator |

Must be one of the following: "N", "W", "X", "Y" |

Format validation |

|

19-20 |

2 |

Transaction Code |

For most transactions, this will be 53, business expenses. |

Transfer reason |

|

21-30 |

10 |

Amount |

Only numeric valid. Must be greater than zero. Shown in cents without punctuations. Right justified, zero-filled. Unsigned. |

Amount recipient receives |

|

31-62 |

32 |

Title of Account to be credited |

Must not be all blanks. Left justified, blank filled. |

Account name |

|

63-80 |

18 |

Lodgement Reference |

Left justified, blank-filled. |

Transfer reference (shared with the recipient) |

|

81-87 |

7 |

Trace Record (BSB Number in format XXX-XXX) |

Must be numeric with a hyphen in character position 5, e.g., BSB 012-666 |

Format validation |

|

88-96 |

9 |

(Account number) |

Right justified, blank filled. |

Format validation |

|

97-112 |

16 |

Name of Remitter |

Must not contain all blanks. Left justified, blank filled. |

Format validation |

|

113-120 |

8 |

Amount of Withholding Tax |

Not supported. Right justified, zero-filled. Unsigned. Can be "00000000" |

Format validation |

File Total Record (type 7)

| Character Position | Field Size | Field Description | Specification | Field Mapping |

|

1 |

1 |

Record Type 7 |

Must be '7' |

Format validation |

|

2-8 |

7 |

BSB Format Filler |

Must be '999-999' |

Format validation |

|

9-20 |

12 |

Blank |

Must be kept blank. |

Format validation |

|

21-30 |

10 |

File (User) Net Total Amount |

Numeric only valid. Must equal the difference between File Credit & File Debit Total Amounts. Show in cents without punctuation. Right justified, zero-filled. Unsigned. |

Format validation |

|

31-40 |

10 |

File (User) Credit Total Amount |

Numeric only valid. Must equal the accumulated total of credit Detail Record amounts. Show in cents without punctuation. Right justified, zero-filled. Unsigned. |

Format validation |

|

41-50 |

10 |

File (User) Debit Total Amount |

Numeric only valid. Must equal the accumulated total of debit Detail Record amounts. Show in cents without punctuation. Right justified, zero-filled. Unsigned. |

Format validation |

|

51-74 |

24 |

Blank |

Must be kept blank. |

Format validation |

|

75-80 |

6 |

File (user) count of Records Type 1 |

Numeric only valid. Must equal the accumulated number of Record Type 1 items on the file. Right justified, zero-filled. |

Format validation |

|

81-120 |

40 |

Blank |

Must be kept blank. |

Format validation |