This article will help you understand your Airwallex Online Payment fees and how to reconcile them back to your payments received.

What is the settlement timing of my revenue and fees?

Every Online Payments customer will have an agreed settlement timing that is determined based on your risk and reserve requirements from Airwallex, and can also vary by payment method.

This settlement timing determines when your revenue, net of fees, will be available in your Airwallex wallet balance. For the majority of your card transactions, they will settle within your agreed settlement timing.

The two options for settlement timing are:

- Delayed settlement of T + N: Payments that happen on Day 1, will settle by Day N (excludes weekends and public holidays)

For example, if you have a T + 5 delayed settlement. Payments that happen on Day 1, will settle by Day 6, less the payment fees.

- Rolling reserve with T + 3 and X% reserve hold: Payments that happen on Day 1, will settle by Day 3 less your nominated reserve hold (excludes weekends and public holidays)

For example, if you have a 10% for 30 days rolling reserve. Payments that happen on Day 1, will settle by Day 4, less payment fees and the 10% reserve.

For more information about reserves: What is a reserve, why do I have one, and how much is it?

What are all the fees charged on each transaction?

See our fee schedule for full information on your fees.

| Fee | Settlement Timing | How it works |

| Gateway and 3DS fee |

T + N when your payment settles T + 3 for failed payments |

This fee is charged for each payment attempt as it incurs a fee from the payment scheme, including on failed transactions. This is incurred in the transaction currency (e.g. for a USD transaction, fees will be charged in USD). |

| Payment method fee | T + N when your payment settles |

This fee is based on the payment method used by your customer, see here for the full list of payment methods. Incurred as a percentage on the transaction amount and currency. |

| Foreign currency conversion or settlement fee | T + N when your payment settles |

This fee is based on your transaction and settlement currency. Incurred as a percentage on the transaction amount and currency. |

| GST |

T + N when your payment settles |

See here for more information: How is GST charged for Online Payment transactions? |

Example #1: T + 5 settlement timing with an AUD 100 payment

Day 1: AUD 100 payment is made by your customer

- Payment can be seen in your Payments dashboard as ‘pending’

Day 6: AUD 98.05 will settle and be available in your Airwallex wallet, less the AUD0.30 gateway fee and the AUD1.65 payment method fee (including GST)

Example #2: Rolling reserve of 10% for 30 days for an AUD 100 payment

Day 1: AUD 100 payment is made by your customer

- Payment can be seen in your Payments dashboard as ‘pending’

Day 4: AUD 88.05 will settle and be available in your Airwallex wallet

- AUD100 less the AUD0.30 gateway fee, AUD1.65 payment method fee (including GST) and the AUD10 reserve hold

- Reserve hold can be seen in your ‘Wallet’ as a reserve balance

Day 34: AUD 10 reserve hold will settle and be available in your Airwallex wallet

How do I see all the fees I’m being charged?

There are five ways to understand your fees:

1) To understand the fees for individual payments, you can see this under the ‘Payment Activity’ section of your WebApp

Click into the payment

Navigate to the ‘Settlement’ section to see a breakdown of the fees. These fees exclude GST. See #4 for the GST component of your fees.

2) To understand the fees associated on a batch of payments, you can view a summary amount, fees and download a report

Under ‘Wallet’ and ‘Transactions’, you will see all the pending and settled amounts

You can find a detailed summary of the total amount, fees and the option to download a report

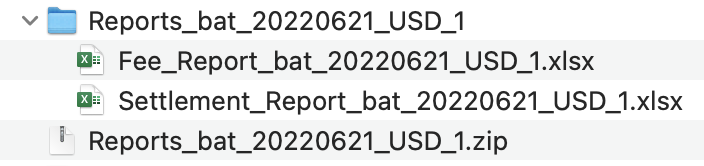

If you click “Download settlement report”, you will be able to receive a zip file containing both the overall settlement report and detailed fee report

In the settlement report, you can find the payment method fee, card interchange and scheme fee(if applicable) being netted from each single payment revenue, and you can also find the summary of the rest of the fees displayed in the Fee row

You can then find the breakdown of Fee row in the fee report

3) To reconcile your fees in Xero, your Xero Online Payments feed will separate out each transaction, revenue and fees associated

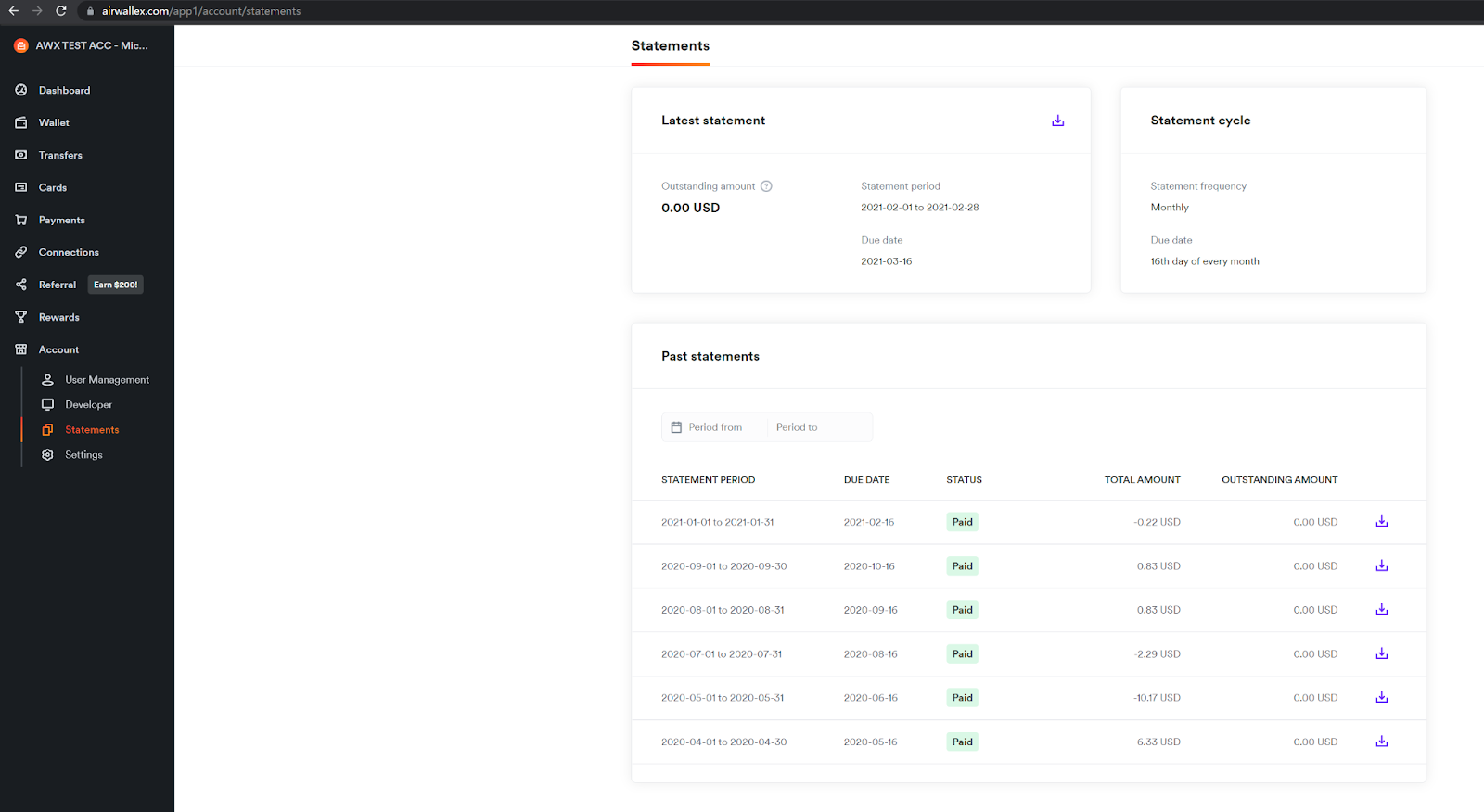

4) To view your GST incurred for the given period, you can find this in your monthly Invoice under ‘Account’ and ‘Statements’

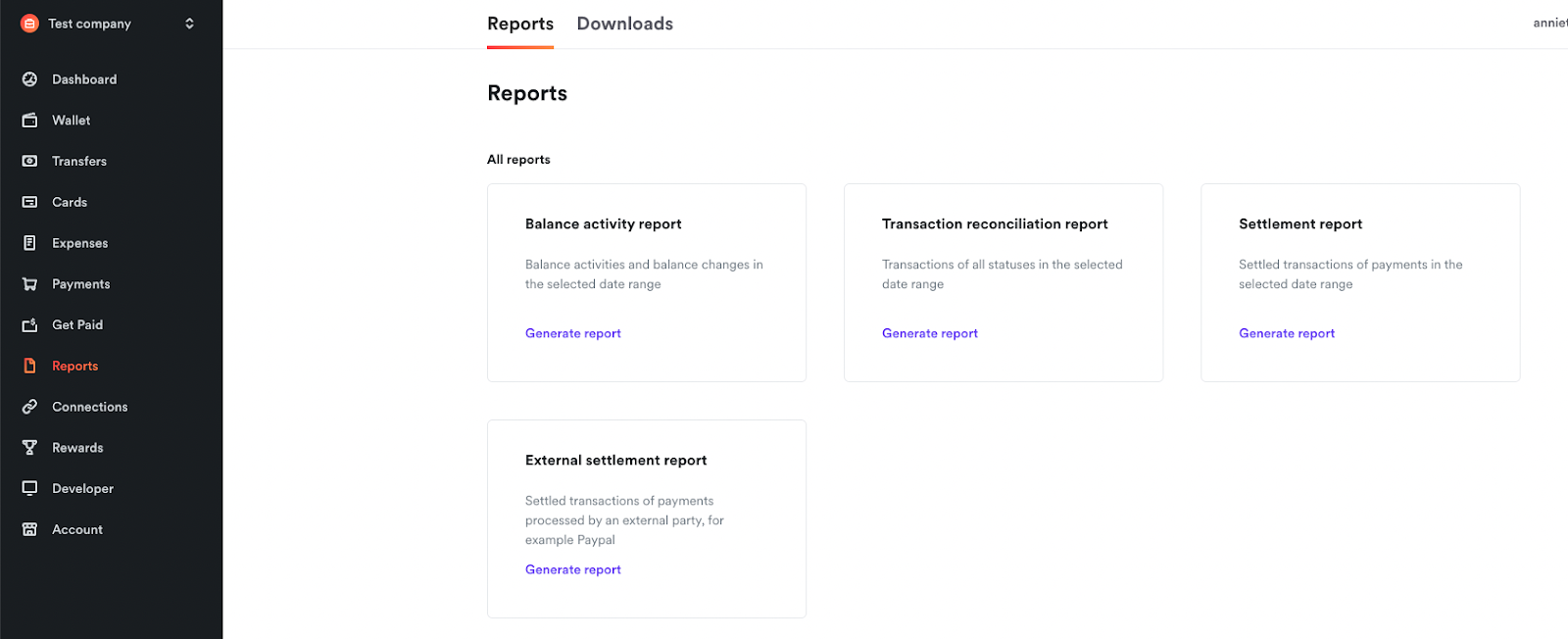

5) To view a complete summary of all fees in a given period, you can export a custom settlement report that outlines the transaction and settlement amount, currency, FX rate and related fees.

You can also use the ‘payment attempt ID’ field to reconcile this back to your Payment Activity export.